Reglas del juego bancarrota

Bankruptcy rules are the set of rules and regulations that govern how businesses and individuals file for bankruptcy. These rules are designed to protect the rights of creditors and debtors, and to ensure that bankruptcy proceedings are fair and orderly.

The Bankruptcy Code is the primary source of bankruptcy law in the United States. The Code is divided into several chapters, each of which governs a different aspect of the bankruptcy process. The most commonly used chapters are Chapter 7, which governs liquidation bankruptcies, and Chapter 11, which governs reorganization bankruptcies.

In a liquidation bankruptcy, the debtor's assets are sold off and the proceeds are used to pay creditors. Liquidation bankruptcies are typically used by businesses that are unable to reorganize their debts and continue operating. In a reorganization bankruptcy, the debtor's assets are not sold off, but the debtor is required to develop a plan to repay creditors over time. Reorganization bankruptcies are typically used by businesses that are able to continue operating but need time to restructure their debts.

There are two types of creditors in a bankruptcy: secured creditors and unsecured creditors. Secured creditors are creditors who have a security interest in the debtor's assets. This means that if the debtor fails to repay the debt, the creditor can seize and sell the debtor's assets to recoup the debt. Unsecured creditors are creditors who do not have a security interest in the debtor's assets. Unsecured creditors are typically paid after secured creditors, and they may not be paid in full.

The Bankruptcy Court is the court that has jurisdiction over bankruptcy cases. The Court is responsible for overseeing the bankruptcy process and approving or rejecting the debtor's reorganization plan.

The trustee is the individual appointed by the Court to oversee the debtor's bankruptcy case. The trustee's duties include collecting and selling the debtor's assets, distributing the proceeds to creditors, and overseeing the debtor's compliance with the bankruptcy code.

The automatic stay is a provision of the bankruptcy code that prevents creditors from collecting on debts owed by the debtor. The automatic stay goes into effect when the debtor files for bankruptcy and remains in effect until the bankruptcy case is concluded.

The discharge is a court order that releases the debtor from personal liability for certain types of debts. Once a debtor is discharged, the debtor is no longer legally obligated to repay the discharged debts.

Listado top ventas para Reglas del juego bancarrota

Queremos que con este listado de productos encuentres reglas del juego bancarrota al mejor precio y buena calidad para el bienestar y cuidado de juegos. Te aseguramos que llegarás a encontrar la mejor selección de productos y precios de todo lo que busques para juegos de mesa, ofreciéndote la oportunidad de descubrir numerosas marcas y referencias.

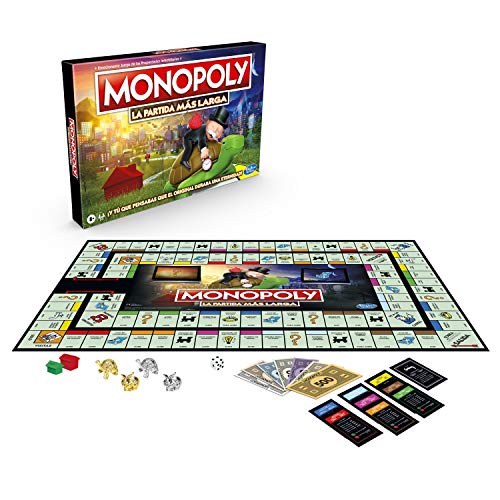

Monopoly- Longest Game Ever, Multicolor (Hasbro E8915105)

- SIGUE JUGANDO: Piensas que jugar el juego Monopoly se tarda una eternidad; ni se acerca a esta edición del juego Monopoly, el juego Monopoly más largo de la historia

- JUEGO MÁS LARGO: Ni siquiera la bancarrota dejará a un jugador fuera de este juego Monopoly; el juego no termina hasta que alguien se quede con todas las propiedades, y hay 3 versiones de cada una en este juego de mesa

- JUEGO EXTRA LARGO: Créenos cuando decimos que es largo; tiene 66 propiedades y hay un solo dado; no hay más dobles, de modo que siéntate y prepárate para pasar mucho tiempo en el tablero

- DIVERTIDO JUEGO FAMILIAR: Reúne a amigos y a tu familia para jugar y jugar y seguir jugando, este juego de mesa Monopoly; termina cuando un jugador es dueño de 16 calles, 4 ferrocarriles, 2 servicios públicos y todas las propiedades

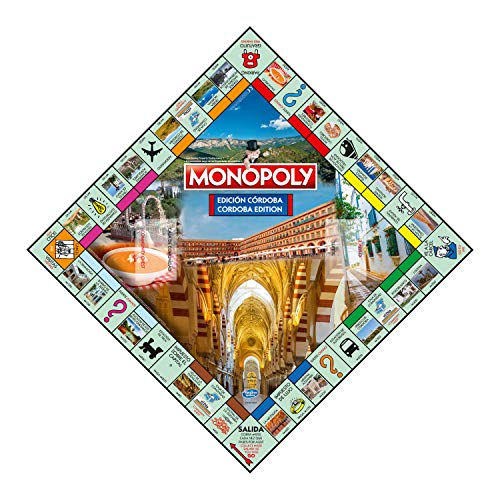

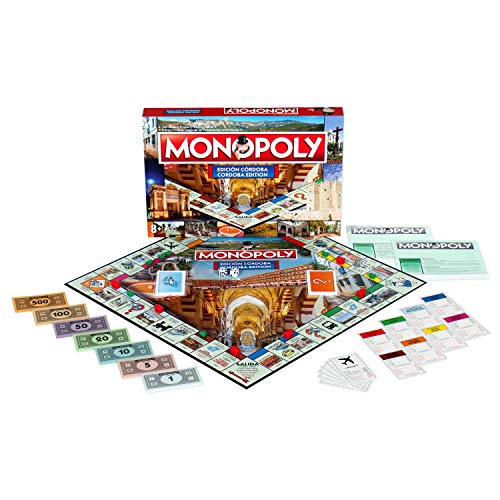

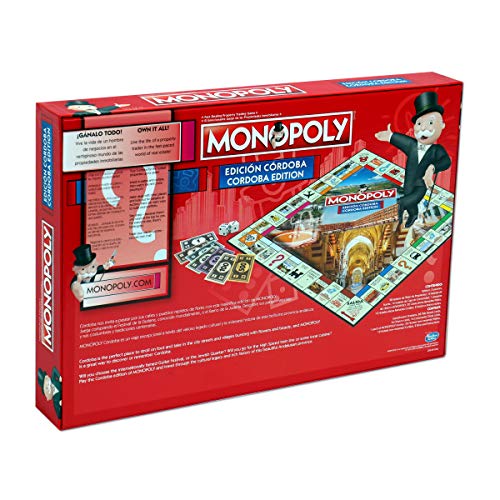

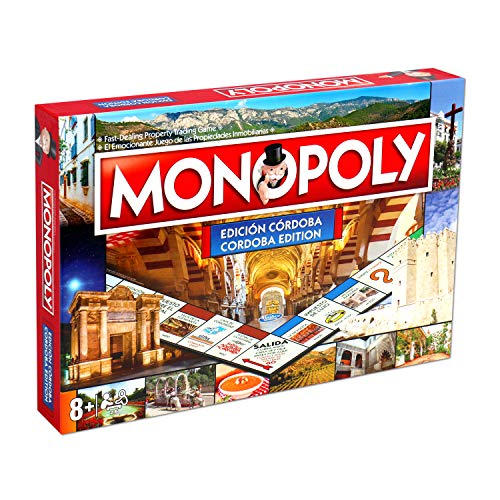

Winning Moves Monopoly Córdoba (10544), multicolor (ELEVEN FORCE

- MONOPOLY Córdoba es un viaje excepcional a través del extenso legado cultural y la milenaria historia de una de las provincias andaluzas más bellas. Córdoba nos invita a pasear por sus calles y pueblos repletos de flores.

- Juega comprando su Festival de Guitarra o el Barrio de la Judería mientras descubres sus múltiples costumbres y sus increíbles parajes naturales…

- Avanza hasta la Medina Azahara, Pozo Blanco o la Sinagoga – ¿conseguirás que te paguen el alquiler?

- Invierte en casas y hoteles Patios y Cortijos en esta edición) y consigue ganar la partida.

- El divertido juego para que toda la familia se divierta negociando con propiedades inmobiliarias

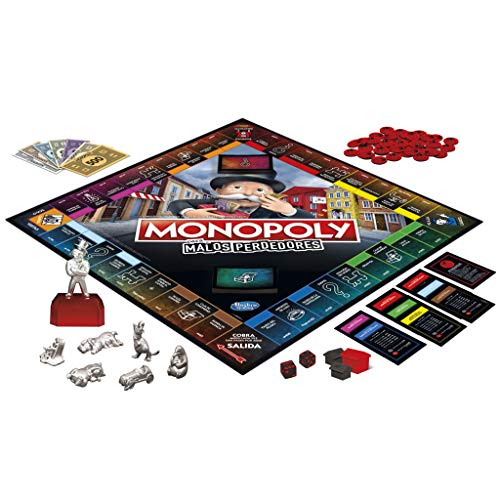

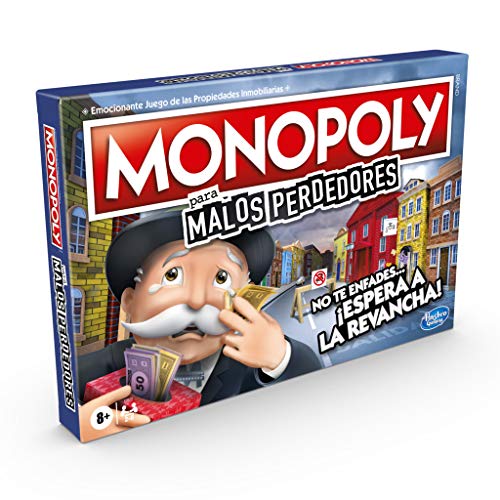

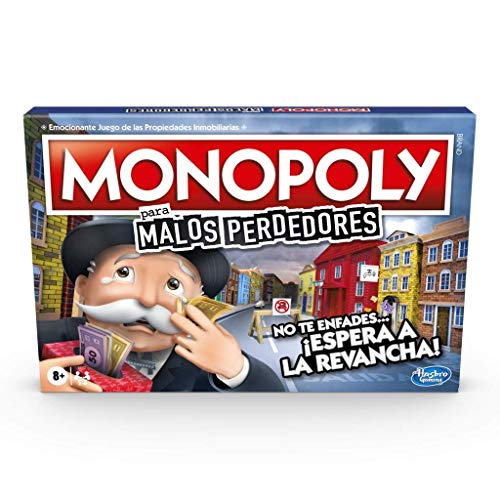

Monopoly - Malos Perdedores - Hasbro E9972105

- PERDER PARA GANAR: Oh, la emoción de la revancha, con la divertida edición del juego de mesa Monopoly, las cosas molestas, como pagar el alquiler o ir a la Cárcel, en realidad ayudan a los jugadores a avanzar

- RECOGE MONEDAS: El juego Monopoly malos perdedores hará que los jugadores deseen caer en espacios inútiles del tablero, pagar impuestos y alquiler e incluso ir a la cárcel porque recogerán monedas Malos Perdedores

- FICHA DE MR. MONOPOLY: Perder es solo el comienzo! Obtén 4 monedas Malos perdedores y canjéalas por la ficha de Mr. Monopoly que les permite a los jugadores pisar fuerte en el tablero cobrando dinero en lugar de pagar

- CELEBRA LA DERROTA: Perder es horrible, atodos nos ha ocurrido y hemos sentido el dolor, pero ahora se ha vuelto divertido, las tarjetas de suerte y las tarjetas de caja de comunidad crean y celebran a los malos perdedores

- JUEGO FAMILIAR GENIAL: reúne un grupo de personas para jugar a este juego de mesa Monopoly para familias y niños a partir de 8 años, es un juego divertido para la noche de juego en familia y otras reuniones familiares

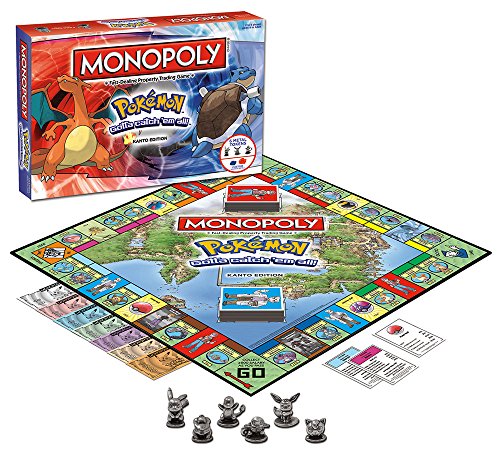

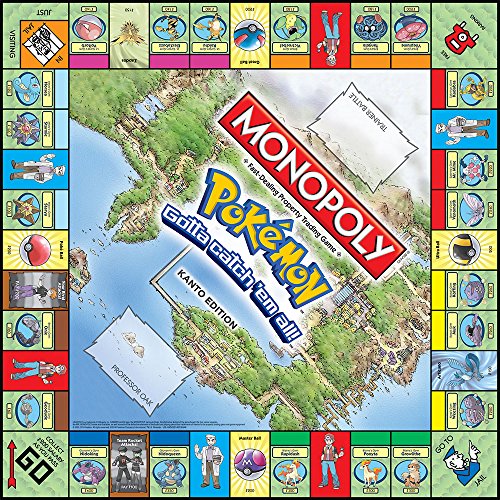

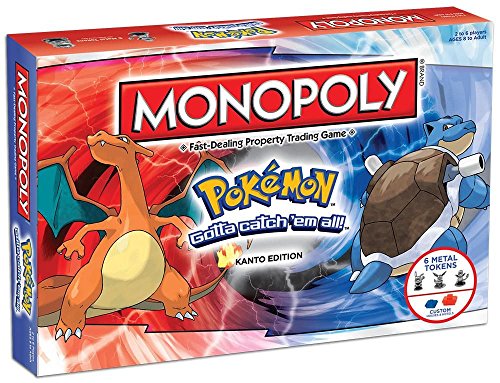

Monopoly: Pok'mon - Kanto Region Edition - Inglés

- Visite sus álbumes y lugares favoritos de AC / DC, como Stiff Upper Lip y Let There Be Be Rock, pero tenga cuidado con las tarifas de estudio de grabación, las entradas para conciertos, la cárcel y la bancarrota.

- Advance a Powerage o Highway To Hell - Will You Owe Alquilar o Cosecha la Recompensas?

- Invest en Dorado Records y Platinum Récords y Comercio Your Way To Success.

- El mejor juego de mesa familiar del mundo te trae otra emocionante edición de MONOPOLY - Edición AC / DC.

- Elige tu token favorito de Cannon, Dynamite, Lightning Bolt, Angus 'Hat, Stacks of Cash y the Bell.

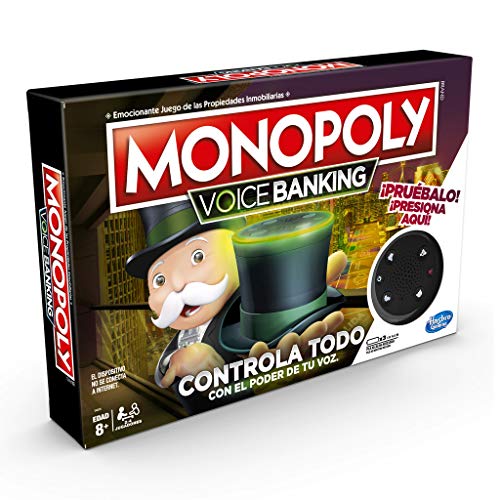

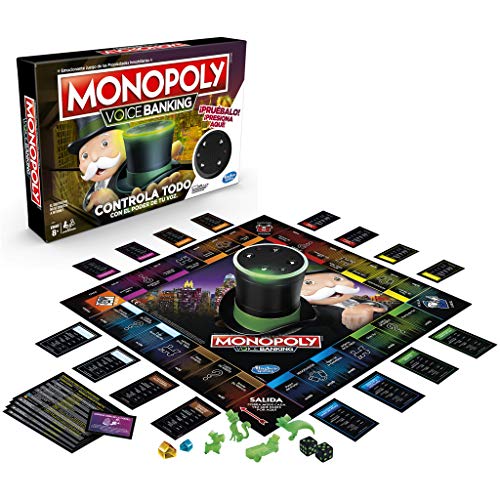

Monopoly - Voice Banking (Hasbro E4816SO0)

- El reconocimiento de voz llega a monopoly; en este juego de mesa electrónico, mr; monopoly es el banquero y gestiona el dinero de los jugadores con su sombrero

- Habla, que mr; monopoly te escucha; pulsa el botón y verbaliza una orden como «pagar el alquiler de marvin gardens»; mr; monopoly responderá y transferirá el dinero a la cuenta de tu oponente

- Juega más rápido; los jugadores aterrizan en una casilla de intercambio obligado y le indican a mr; monopoly qué propiedades quieren intercambiar; construye más rápido y consigue las casas y hoteles antes que nadie

- Olvídate del efectivo y las tarjetas; la unidad electrónica bancaria de mr; monopoly se ocupa de gestionar las finanzas, ya se trate de comprar propiedades, pagar o cobrar el alquiler, consultar saldos y mucho más

- Diviértete en familia; el juego es para 2 a 4 jugadores (mayores de 8 años) y ofrece un plan genial para una noche de juegos en familia

Giochi Uniti SL0058 - Juego de ferrovias y Capitanes de Industria

- Construye los grandes ferrocarriles de América.

- Juego de gestión para tres a seis personas, jugable en tres a cuatro horas.

- Excelente diseño y jugabilidad, baja dependencia de la suerte.

- Gran regalo para los más pequeños.

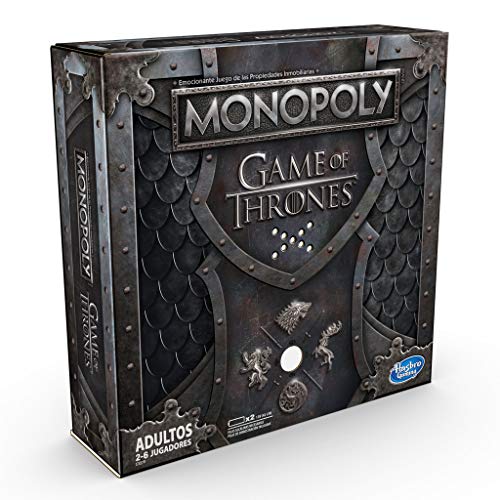

Monopoly - Juego de Tronos, versión Española (Hasbro E3278105)

- Diviértete con tu juego preferido monopoly con tus personajes favoritos de juegos de tronos

- Basado en la serie de televisión de éxito de hbo; los fans de juego de tronos podrán viajar a las legendarias tierras de westeros mientras compran, venden e intercambian lugares de los siete reinos en esta edición del juego de monopoly

- Peones de juego de las grandes casas; los 6 peones del juego de monopoly se inspiran en los escudos de armas de las grandes casas; ¿a quién vas a prometer lealtad?

- Dinero y dibujos de Juego de Tronos; incluye 42 dragones de oro y 53 ciervos de plata de monedas de cartón, y los dibujos del tablero de juego y de la caja se inspiran en la serie de TV de HBO, Juego de Tronos

- Fortalezas y castillos; esta versión del juego de Monopoly incluye 32 fortalezas y 12 castillos en lugar de casas y hoteles, y las propiedades son lugares de la serie de TV

- Tema principal de Juego de tronos incluye un tarjetero del Trono de Hierro con un soporte musical que reproduce el tema principal de Juego de Tronos; pulsa el botón del soporte para reproducirlo

Imágenes de Reglas del juego bancarrota

Te mostramos aquí un conjunto de imágenes de reglas del juego bancarrota para que te formes una idea y puedas seleccionar entre todos los tipos de juegos. Pincha con el ratón en una de las fotos para ver la ficha entera del producto y su costo.